Financials

Third Quarter Financial Statement And Dividend Announcement

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

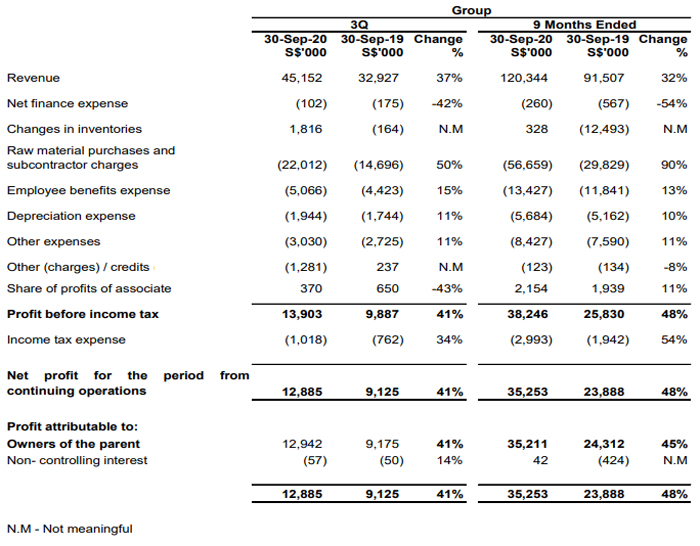

UNAUDITED CONSOLIDATED INCOME STATEMENT FOR THE PERIOD ENDED 30 SEPTEMBER 2020

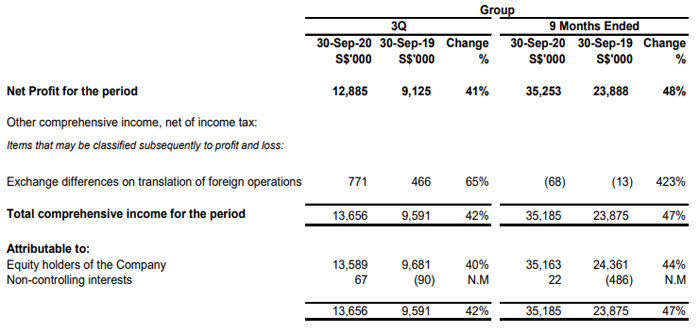

Consolidated Statement of Comprehensive Income

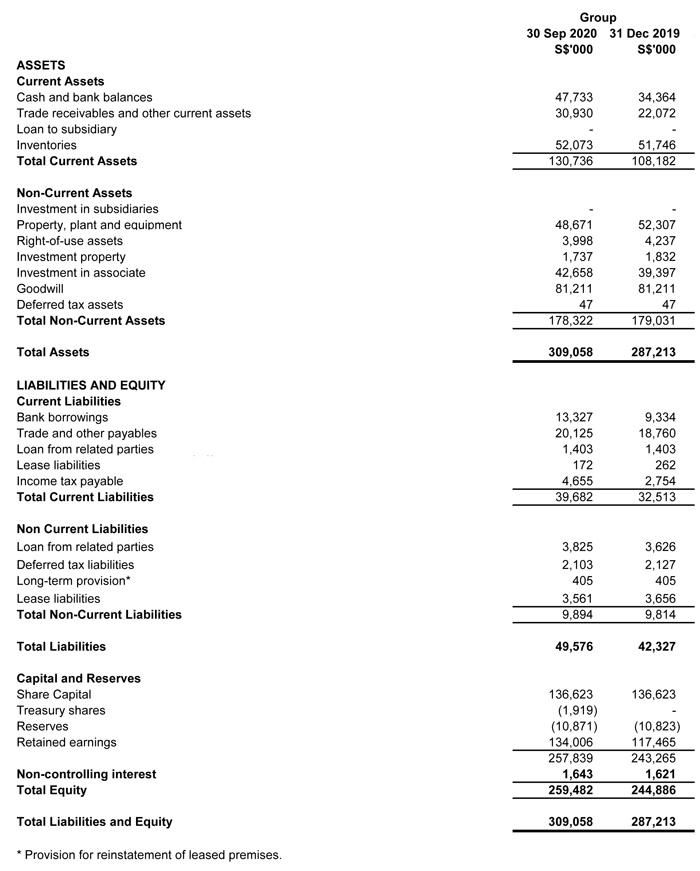

Balance Sheet

Review Of Performance

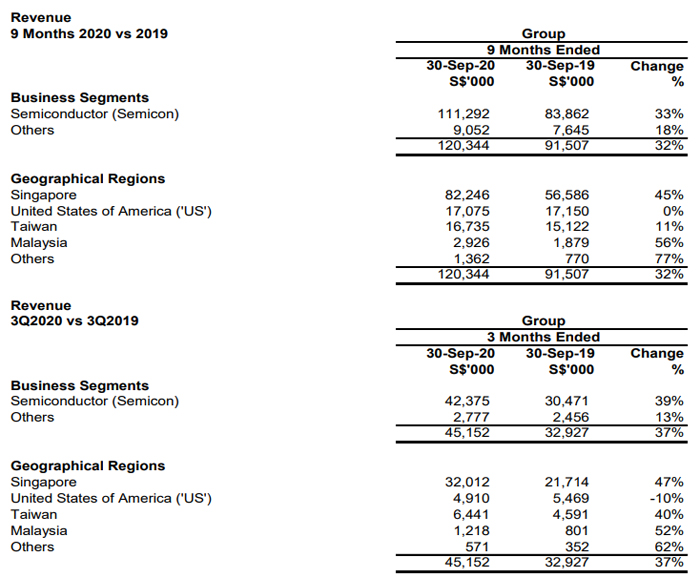

Revenue

3QFY2020

Group revenue continued to grow significantly - rising by 37% year-on-year to S$45.2 million in 3QFY2020 on the back of robust growth in all its core business segments.

Semiconductor sales shot up by 39%, driven mainly by higher Integrated System sales which rose 63% from S$14.3 million in 3QFY2019 to S$23.4 million in 3QFY2020.

Revenue from component sales went up by 18% to S$19.0 million in 3QFY2020 from S$16.1 million in 3QFY2019.

Sales in "Others" segment increased 13% mainly due to higher material distribution by its subsidiary - Starke Singapore.

On a sequential basis, compared to 2QFY2020, revenue from the Semiconductor segment went up 13.9%, while Others segment eased 11.1% to S$2.8 million.

Geographically, all the Group's key markets except US, reported strong revenue growth. Sales in Others leapt 62% driven by higher component sales while the 52% revenue jump in Malaysia was due to higher material distribution. Singapore also recorded a 47% sales surge compared to 3QFY2019 which was mainly attributed to increased Semiconductor Integrated System sales. Taiwan enjoyed an increase of 40% on the back of higher component spares sales.

US sales softened by 10% in 3QFY2020 due to lower component sales for new systems built

9MFY2020

Revenue for 9MFY2020 surged 32% to S$120.3 million compared to S$91.5 million for the first nine months of FY2019 as the Group's core business segments reported stronger results. Sales in the Semiconductor segment grew 33% while its Others segment rose 18%. Revenue went up in all of the Group's key markets, except US which remained relatively stable. Stronger Semiconductor Integrated System demand pushed Singapore sales up by 45% while revenue in Taiwan, Malaysia and Others climbed 11%, 56% and 77% respectively.

Profitability

3QFY2020

Group net profit attributable to shareholders surged 41% to S$12.9 million from S$9.2 million in 3QFY2019 with strong growth from both Semiconductor Integrated Systems and Component sales.

Gross material margin in 3QFY2020 remained relatively stable at 55.3% from 54.9% in 3QFY2019.

The much stronger profit performance was achieved despite lower contribution from its associate, higher expenses and a foreign exchange loss of S$1.3 million from the depreciation of the US currency (vs a foreign exchange gain of S$0.3 million in 3QFY2019).

JEP Holdings Ltd's ("JEP") share of profit dropped 43% from $0.65 million to $0.37 million due to challenges faced in the aerospace industry caused by the ongoing global COVID 19 pandemic.

Expenses increased during the quarter. Personnel costs rose 15% mainly due to higher bonus provisions made. Depreciation increased by 11% due to fixed assets added during the second half of FY2019.

Other expenses went up 11% over last year due to higher production activities. Freight charges jumped 49% while the costs of upkeep of machinery and utilities increased 12%, and 4% respectively. Professional and legal fees also rose during the quarter.

The Group's income tax expense increased 34% in line with its higher profit.

9MFY2020

The Group's net profit attributable to shareholders for the 9 months surged to S$35.2 million exceeding the Group's full year FY2019 net attributable profit of $33.6 million.

It recorded a 45% jump in net attributable profit - compared to 3QFY2019 in spite of higher expenses.

The robust performance was fueled by higher semiconductor sales and a 11% increase in JEP's share of profits from S$1.9 million to S$2.2 million in 9MFY2020.

More income taxes were incurred during 9MFY2020 as a result of higher profit recorded.

Cashflow

3QFY2020

The Group's financial position remains robust. It registered S$12.3 million positive net cash from operating activities and S$11.6 million free cash flow in 3QFY2020.

9MFY2020

In 9MFY2020, the Group generated S$32.4 million in positive net cash from operating activities and S$30.9 million free cash flow.

Its net cash and cash equivalents (net of bank borrowings) improved to S$34.4 million as at 30 September 2020 compared to S$25 million as at 31 December 2019.

The Group's cash balance went up even after its increased investment of $1.1 million in JEP Holdings, share-buyback of S$1.9 million and a dividend payment of S$18.7 million to shareholders

Commentary

The Group delivered a sterling performance in the first nine months of FY2020 as it remained a beneficiary of the strong and sustained global semiconductor demand. Group earnings for the nine months had already exceeded FY2019's full year earnings.

This demonstrates UMS's operational resilience and ability to respond quickly to customer demands in spite of unprecedented supply chain disruptions and factory lockdowns caused by the COVID 19 pandemic.

Looking ahead, global chip demand is expected to stay solid.

In the short to medium term, according to SEMI's forecast, global fab equipment billings climbed 26% and 8% sequentially to US$16.8 billion y-o-y in 2QFY2020. While SEMI forecasts global fab equipment spending to increase by 8% in 2020 to approximately US$60 billion, 2021 is expected to see capex of US$67.7 billion, a 13% increase1. This will be driven by the pandemic-induced demand for chips, from gaming, communications, IT infrastructures, data centers and healthcare electronics.

According to Global Market Insights, the adoption of technologies such as, artificial intelligence (AI), IoT in fabrication and the constant use of advance chipsets in automotive and consumer electronics, will drive the demand for semiconductor manufacturing. This demand will boost support for the semiconductor manufacturing equipment market and is projected to reach over US$80 billion by 2026.2

These strong growth figures augur well for the Group and with its strong financial position, it is well-poised to capitalize on growth opportunities arising from the vibrant chip equipment manufacturing market and the acceleration of digital innovations such as 5G and adoption of smart cities solutions worldwide.

While global tech demand stays buoyant, uncertainties remain in the near-term with the resurgence of COVID-19 as well as growing competition, rising costs and softer memory pricing arising from possible inventory adjustments.3&4

To allow the Group greater financial flexibility and to take advantage of new growth initiatives in the short-term, the Board has recommended moderating the dividend payout to shareholders for 3QFY2020.

This is a prudent measure taken against a backdrop of global economic challenges as the Group wishes to conserve cash to maintain a strong balance sheet in order to drive future business growth which could reap longer term returns to shareholders.

Barring any unforeseen circumstances, the Group will remain profitable in 2020.

1Source: Global fab equipment spending to rise in 2020 and 2021, says SEMI https://www.digitimes.com/news/a20200909PR202.html

2Source: Semiconductor Manufacturing Equipment Market is Projected to Reach USD 80 billion by 2026 - https://www.semiconductordigest.com/2020/09/04/semiconductor-manufacturing-equipment-market-is-projected-to-reach-usd-80-billion-by-2026/

3Source: Samsung predicts fourth-quarter decline in profits due to weak demand and growing competition: https://www.cnbc.com/2020/10/29/samsung-q3-2020-earnings-forecasts-weak-demand-amid-competition.html

4Source: Samsung Warns of Weaker Outlook Even as Profit Beats: https://www.bloomberg.com/news/articles/2020-10-28/samsungbeats-profit-estimates-boosted-by-strong-handset-sales